Mezzanine debt and preferred equity are similar in the role each plays. Understanding the nuance of mezzanine debt vs preferred equity can help you appropriately fill a gap or provide leverage for your commercial real estate investment. Both CRE financing options sit between senior debt and common equity in the commercial real estate capital stack.

When determining the best financing choice for your real estate investing activity, consider:

- Appetite for risk

- Appetite for bringing in other equity stakeholders

- The interest level you’re comfortable with

Let’s explore the CRE capital stack and the distinguishing factors of mezzanine debt vs. preferred equity.

The Commercial Real Estate Capital Stack

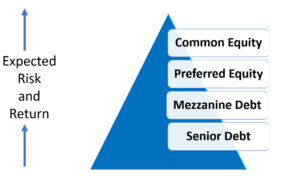

The commercial real estate capital stack represents the kind of debt and equity used to finance a transaction in real estate. There are generally at least two or three “layers” of financing for major projects, including:

- Senior debt from a bank or finance institution

- Junior debt (sometimes called mezzanine debt) from private funds

- Preferred equity from private funds and investors

- Joint Venture equity from family offices and institutional capital funds

Senior debt (such as a bank mortgage) is secured, and it is in the first lien position on a commercial property. As you move up the capital stack, the level of stakeholder risk and expected return increases.

Mezzanine Debt Financing

Mezzanine financing is typically secured behind the senior debt and used to raise capital beyond what a bank or finance company provides. Companies often use it for high-value projects like new construction, which promise high returns through residential or commercial rents. This secondary financing arrangement carries high-interest rates to compensate for investors for taking on risks without an immediate equity stake.

Advantages of Mezzanine Financing for Borrowers:

• Improve levered returns for investors and developers

• A current pay component and accrued pay component provide more flexibility

• Lower the equity raise amount

What to consider when using Mezzanine Financing

• Higher cost of capital

• Impact on project delays – potential need to replenish interest reserves

• Allowance for mezzanine financing by senior lender, and associated legal cost

Real estate investors who aren’t as keen to share in equity returns but need capital for costs beyond their mortgage are best suited for mezzanine debt.

Preferred Equity

Preferred equity also typically sits behind a senior commercial real estate loan. If sponsors default on their financial obligations, preferred equity investors can step in and take control. Their repayment is typically ahead of the principal investors via cash flow and sale or refinance. Sometimes preferred equity investors gain from the appreciation of a property when it is sold.

Advantages of Preferred Equity for Borrowers:

• Improve levered returns for investors and developers

• A current pay component and accrued pay component provide more flexibility

• Lower the equity raise amount

What to consider when using Preferred Equity:

• Higher cost of capital

• Impact on project delays – potential need to replenish interest reserves

• Allowance for secondary financing by senior lender, and associated legal cost

Recap

The best commercial real estate finance arrangement for your business is one that aligns with your appetite for:

- Risk

- Debt

- Equity sharing

There are many possibilities within the capital stack to fund a construction project or development. Combining finance options may best align with your appetite for risk, debt, and equity sharing. Preferred equity and mezzanine financing are two of the most popular options in the spectrum between debt and equity.

Sourcing the most lucrative combination of financing options takes knowledge, creativity, and contacts. Each commercial real estate project has unique business requirements. Contact Max Friedman and his team to discuss your capital requirements.